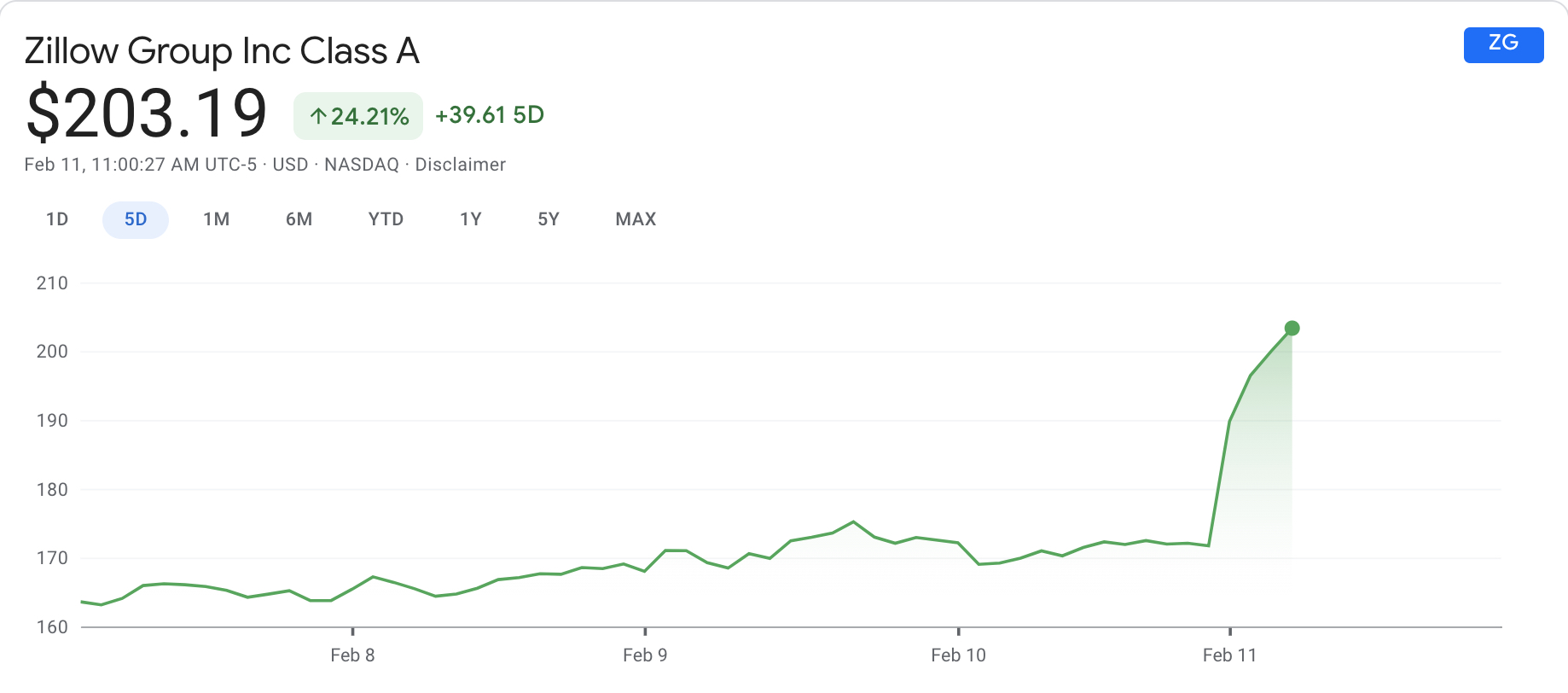

A number of analysts moved the goalposts on Zillow this week, upgrading the company’s target share price to $200 per share. With the markets open for less than two hours the day after the company revealed its acquiring ShowingTime and reported its most profitable quarter in company history, Zillow’s class A stock soared right past that goal.

The company was trading at around $202 per share at 11 a.m., Thursday, an increase of $31 or 18 percent from where it closed the day prior, before its earnings call.

The massive movement came on the heels of Zillow reporting a net income of $46 million in the fourth quarter of 2020, its most profitable quarter in company history and the first time since the company began trading publicly that its posted consecutive profitable quarters.

In the same report, the company revealed that its iBuyer business is continuing to scale back up from its early pandemic pause and it actually made money, on average, on each Zillow Offers home it sold in the quarter. Zillow Offers gross profit in the fourth quarter was $27 million and the company’s gross profit on homes sold was, on average, $19,206, after interest expenses.

The biggest breadwinner was the company’s Internet, Media and Technology segment of the business, which posted revenue of $424 million.

While the headline financials were strong, the company also announced it agreed to acquire real estate showing management and market analytics company ShowingTime for $500 million. While the move rankled many real estate agents, Zillow told Inman it plans to continue to operate ShowingTime as an open platform.

“I think the key here is our intention to operate this as an open platform with the same rules for everybody, doesn’t matter which brokerage, which franchisor you’re with, what brand you’re affiliated with,” Errol Samuelson, Zillow’s chief industry development officer, told Inman. “The goal here is to have an open and equitable platform for all users. That’s not changing.”

The post-earnings and acquisition news stock surge follows what’s been a tremendous year for Zillow in the public market. In the early days of the pandemic, the company saw its share price plummet to roughly $25 per share, before steadily rising throughout the year, finally hitting the $200 mark for the first time in company history Thursday.

It should be noted as well that Zillow split its stock in the past.