This post has been republished with permission from Mike DelPrete.

It’s earnings season, which means press releases with huge numbers and big percentage gains but light on helpful context.

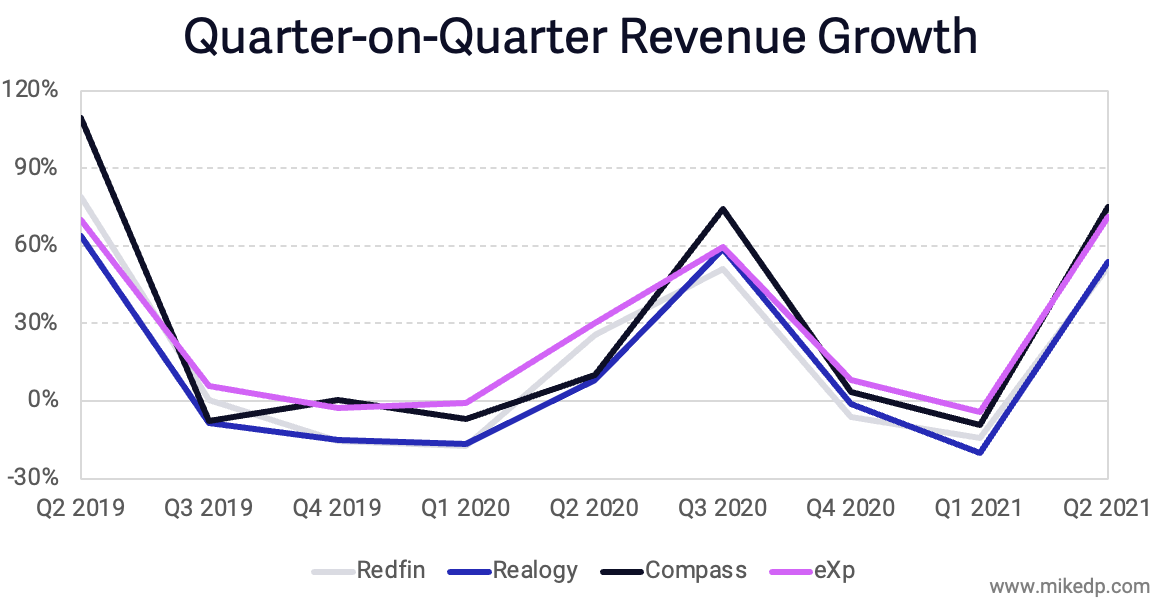

Compass posted big numbers; its quarterly growth is generally in line with its peers, while its record revenue is the result of continuous incremental outperformance.

Pandemic-fueled revenue leap

Compass experienced a significant increase in revenue this past quarter — a seasonal uplift fueled by a hot housing market. Compass has a history of large Q2 revenue jumps (delayed by a quarter in 2020 due to the pandemic).

When it comes to a global pandemic and real estate, a rising tide lifts all boats. Many of Compass’ publicly-listed peers, including Realogy, eXp Realty and Redfin, also experienced record-breaking revenue growth. The quarterly growth rates follow a similar pattern.

They key is that Compass (and eXp) are outperforming their peers by a few percentage points each quarter — the highs are higher and the lows not as low. That compounding effect adds up over time and has resulted in Compass finally surpassing Realogy’s brokerage revenue in Q2 2021: $1.95 billion versus $1.77 billion.

Approaching profitability?

Compass also announced a net loss of only $7 million — a huge improvement over past quarterly losses. The improvement was driven by Compass increasing its revenues and gross profit (by a lot) without a corresponding increase in expenses.

Future profitability hinges on more of the same: a favorable real estate market with a high volume of transactions, without a proportionate increase in expenses.

Strategic implications

Like eXp Realty, Compass’ revenue has increased exponentially over the past two years, driven by incredibly favorable market conditions that have benefited all real estate brokerages — but some more than others.

Huge industry incumbents like Realogy have benefitted the least, while upstarts Compass and eXp have grown the most. Even tech-enabled Redfin, with so much going for it, pales in comparison to its peers.

The hot real estate market has fueled strong growth across the industry. Compass’ growth is noteworthy, and it demonstrates that while the industry moves slowly, some players move faster than others.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.