This report is available exclusively to subscribers of Inman Intel, a data and research arm of Inman offering deep insights and market intelligence on the business of residential real estate and proptech. Subscribe today.

As the real estate industry awaits good news that could point to the end of a choppy period in the U.S., a growing number of economists are backing down from their forecasts that the U.S. is very likely to enter a recession.

The result of whether the Federal Reserve can steer the country away from inflation and also away from a recession has implications for everything from interest rates to the job market and home sales.

And while many economists expected the U.S. would experience at least a mild recession later this year or in 2024, some are beginning to back away from their bearish forecasts following a series of positive economic reports in past few weeks, with more predicting good news while keeping their eyes fixed on the Fed.

“I think that we will just skirt a recession,” Matthew Gardner, chief economist for Windermere Real Estate, told Inman.

That’s a revision from earlier this year, when Gardner and many others believed the country was destined for a recession this year.

Gardner is now forecasting that the economy will slow to a point at which it neither grows nor contracts in the fourth quarter of 2023 before rising again in each quarter of 2024.

But Gardner added a dire warning: “Could we go into a recession if the Fed keeps up this hawkish mentality for longer than — quite frankly — it should? Of course.”

The steep rise in interest rates has kept homeowners — the vast majority of whom have a mortgage rate that is far lower than they’d get with a new 30-year mortgage — from selling their homes. That lack of inventory has kept prices from falling despite the much higher cost of borrowing, which has slowed home sales.

While there’s ongoing pain in real estate, the economy is still growing and wages are rising while inflation has continued to fall.

National Association of Realtors Chief Economist Lawrence Yun said last week that the real estate market has already hit rock bottom.

“The housing recession is over,” Yun said. “With consumer price inflation calming close to the Federal Reserve’s desired conditions, mortgage rates look to have topped out.”

Goldman Sachs analysts have continued to lower their expectations of a recession, saying last month that there’s now a 20 percent chance of a slowdown over the next year.

Bank of America became the first major Wall Street bank to reverse its recession forecast this week, Bloomberg reported.

A Wall Street Journal survey of 70 economists released in late July found that 54 percent of economists surveyed believe the country will enter a recession within the next 12 months. That’s down from a peak of 63 percent in October 2022.

Even staff at the Fed itself initially believed the country was headed for a recession before reversing their prediction last week. They now believe the country will avoid a recession.

“The staff now has a noticeable slowdown in growth starting later this year in the forecast,” Fed Chairman Jerome Powell said last week. “But given the resilience of the economy recently, they are no longer forecasting a recession.”

Not all projections are rosy

Not everyone believes the Fed can pull off what’s known as a soft landing or a successful cool-down of the national economy by raising interest rates without causing job losses and the economy to shrink.

“There’s been much talk of the U.S. achieving a soft landing,” Richard Barkham, chief global economist at the commercial brokerage CBRE, said on Wednesday. “That’s not quite in our scenario. But the path to a soft landing in the United States is certainly wider than it was.”

Barkham’s outlook includes more than just the U.S. economy, and he said there are plenty of indications that things are looking better globally.

China is fully out of its lockdown period and is growing again. Energy prices in Europe fell dramatically after peaking a year ago. And the U.S. has shown an ability to drive down headline and core inflation.

Despite a debt market that rapidly tightened this year, the U.S. job market has remained “uber tight,” wages are growing at a rate that’s more than twice the target level of inflation, and the economy overall has shown “quite remarkable resilience,” Barkham said.

But in order to exit the current cycle of rate hikes, the U.S. might need to see a rise in unemployment, Barkham suggested, adding that CBRE is still predicting a “mild” recession in the fourth quarter of this year and first quarter of next year. Even though hiring has slowed in recent months, employers in July were still adding jobs faster than new workers were entering the job market, a dynamic that continues to drive up wages, according to the latest report Friday from the U.S. Bureau of Labor Statistics.

“I would say the operative word there is mild,” Barkham said. “It’s not a very extended period of negative growth. More like a period of standing still that we have in our house view. Albeit, it’s not quite a soft landing.”

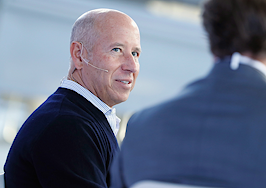

Billionaire real estate investor Barry Sternlicht said last week the Fed’s actions came too late and too strong, and that they would send the U.S. into a recession that he hoped would be “shallow.”

“I’m critical of Powell because…a portion of the data they use is quite lagging. They didn’t see inflation when it was here, and when they showed up they showed up late and big.”

Gardner agreed and said the Fed should pause its rate hikes. But he said housing typically withstands recessions fairly well, aside from the Great Financial Crisis and another recession in the 1990s.

“It’s nothing which I’m worried about from a residential real estate perspective,” Gardner said. “I anticipate them to lower the fed funds rate next year.”

Still, the number of sales might struggle through 2024 if the recent forecast from Fannie Mae economists is correct. Fannie economists believe the economy is still headed for a recession and that home sales will fall to 4.9 million in 2023 and 4.88 million in 2024.

“Our macroeconomic forecast is little changed from last month, including a call for a modest recession beginning in the fourth quarter of this year or the first quarter of next year,” Fannie Mae said last month.

Get Inman’s Property Portfolio Newsletter delivered right to your inbox. A weekly roundup of news that real estate investors need to stay on top, delivered every Tuesday. Click here to subscribe.