Ribbon helps buyers buy before they sell, rescues bad deals and gives first-time buyers a way to win deals in what might be the industry’s first hybrid fintech-proptech application.

Have suggestions for products that you’d like to see reviewed by our real estate technology expert? Email Craig Rowe.

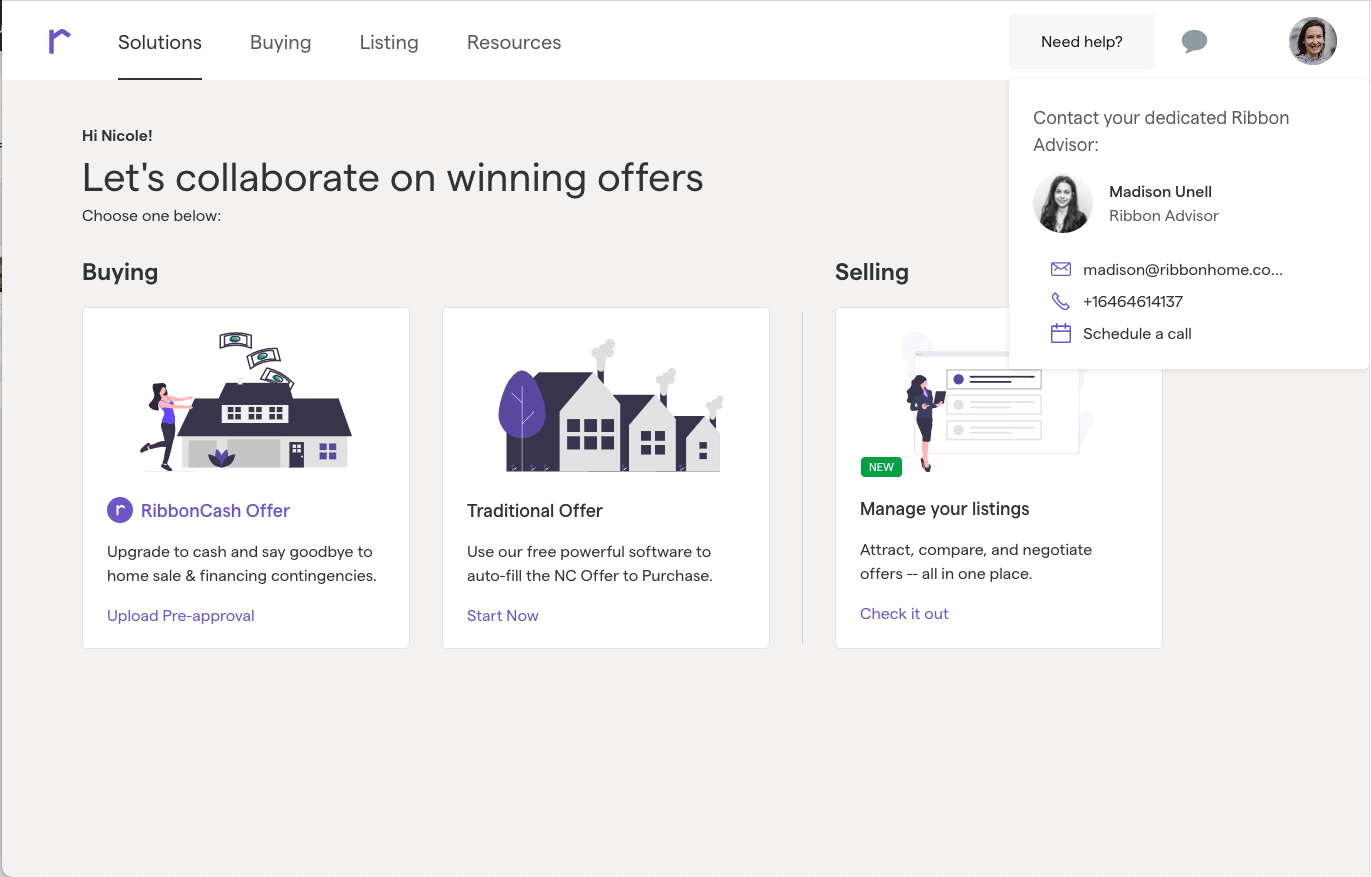

Ribbon is an offer management and mortgage solution for buyer and listing agents.

Platforms: Browser, iOS

Ideal for: Listing agents and buyer rep

Top selling points:

- Built-in financing services

- Fast mobile offer creation

- Guaranteed closing dates

- “Ribbon Rescue”

- Offer management

Top concern:

I’m concerned about the varied approach of Ribbon. Its technical prowess and understanding of what agents need are no doubt sophisticated, but the company’s wide array of included financial services might cloud value proposition for potential agent users.

What you should know

Imagine if a CRM also offered a chauffeur to take buyers on home tours. Sure, that would be appreciated and kind of fun, but it would be an odd appendage for a CRM, right?

Still, I can’t help but like everything Ribbon, a web-based offer management system that integrates a number of in-app fintech services, is trying to do because it combines the offerings of two other industry difference-makers: Knock and WyzeGyde.

In addition to a user experience that lets listing agents compare offers and buyer’s agents create and submit them (very efficiently, I might add), Ribbon has its own alt-mortgage services.

Similar to Knock, you can sell your home to the company to make clean, noncontingent offers on a new one. This is called Ribbon Reserve.

Ribbon Boost is more akin to a traditional mortgage, except that it rapidly underwrites buyers and provides them an “all-cash” offer. This is mainly to give first-time buyers a leg up in the market. A boost.

As Spruce announced last month, Ribbon deploys an underwriting process on its loans that can certify a mortgage within minutes, as opposed to the typical few days. Internally, they call it an “always on” offer.

I find Ribbon Reserve pretty innovative. It’s exactly what it sounds like — a rope and life preserver for deals on the verge of sinking. Whether because of an unruly title search or some newly discovered buyer financial revelations, Ribbon will send in the money to hold the home for the buyer for up to six months while the lawyers and lenders work to right the ship.

The app also gives buyer’s agents one of the cooler, more efficient offer builders I’ve seen in sometime. Totally mobile, too.

Like all great digital form tools, it uses an original design to collect data, in this case a straightforward, visually ergonomic input process for terms and dates, etc. It’s a question-and-answer form displayed on a series of “cards.”

Even better, by combining public records and MLS integrations, Ribbon can prepopulate a good amount of the offer’s property description fields.

Resting on top of HelloSign — a very cool forms product — the offer builder will generate an editable pre-submission version in your state’s standard document. (Ribbon is now operating in North Carolina, South Carolina, Georgia, Texas and Tennessee.)

It can be done on the mobile browser in minutes.

Buyer agents can monitor the status of their buyers’ offers in a left-hand slide-out menu and add “buying power” if needed, which comes in the form of extra money from Ribbon to improve an offer. There’s also a prompt for launching Ribbon Reserve in case the buyer has a home to sell.

Listing agents can use Ribbon to intake and compare offers that are both using traditional lending and Ribbon cash offers, which are guaranteed to close on the agreed-upon date.

If you’re still not sure how to define Ribbon after reading this, don’t worry too much. Just know its intentions and the execution of them are good. While it doesn’t fit into any known category of software or tech-enabled business function, it clearly addresses several common industry challenges, from making sense of multiple offers to what to do when a last-minute hurdle threatens closing.

In truth, I guess it doesn’t matter what round hole this square peg fits into. Point is, it fits directly into the wave of new, inventive solutions changing the way today’s deals get done. And that’s what we need more of.

Have a technology product you would like to discuss? Email Craig Rowe

Craig C. Rowe started in commercial real estate at the dawn of the dot-com boom, helping an array of commercial real estate companies fortify their online presence and analyze internal software decisions. He now helps agents with technology decisions and marketing through reviewing software and tech for Inman.

Comments