It was a challenging year for multiple listing services and trade associations, who are often left holding the bag when one of their own misbehaves or when a big change jars the real estate industry.

The year started off with a bang as the National Association of Realtors grappled with members participating in the Jan. 6 insurrection at the U.S. Capitol. That event and others throughout the year put NAR’s new hate speech policy to the test.

Then Zillow’s acquisition of ShowingTime had MLSs scrambling to respond as their subscribers expressed their displeasure over the deal, with some MLSs taking the novel step of becoming tech investors themselves.

And let’s not forget antitrust. With the U.S. Department of Justice and the Federal Trade Commission scrutinizing the industry’s competitiveness, antitrust investigations and lawsuits hung over industry gatherings and permeated policy discussions. The attention lead to some policy changes at NAR, but left the fates of NAR’s most controversial policies on commissions and pocket listings to be decided in 2022 or beyond.

Here’s a look back at the top news this year for MLSs and trade groups.

Realtors tested NAR’s new hate speech policy

Samuel Corum/Getty Images; Jenna Ryan

In November 2020, NAR’s board of directors approved Standard of Practice 10-5, which reads as follows: “Realtors must not use harassing speech, hate speech, epithets, or slurs based on race, color, religion, sex, handicap, familial status, national origin, sexual orientation, or gender identity.”

A Realtor that violates the policy would be charged under Article 10 of the Realtor Code of Ethics, which prohibits denying equal professional services to anyone in those protected classes.

On Jan. 6, 2021, a mob, with Realtors among them, stormed the U.S. Capitol building and rioted while lawmakers attempted to certify the results of the 2020 election. Some who allegedly participated in the incident were Libby Andrews, an @properties agent who was promptly fired; Jenna Ryan, a Texas-based agent who ultimately received a 60-day jail sentence for her role; and Klete Keller, a former Olympic swimmer turned agent, who took a plea bargain with prosecutors in October.

NAR immediately took a stand against the violence, but did not, however, commit to withhold donations from any of the individuals that voted against certification. Nearly two weeks after the insurrection, the trade group told Inman it had reversed course and was suspending all federal political donations amid calls from some members for changes to its political action committee.

Meanwhile, NAR faced demands from some of its members to hold the Realtors who participated in the attack accountable under its new hate speech policy. The trade group, however, said the Realtor Code of Ethics doesn’t generally apply to criminal activity and that participating in the insurrection was not a violation of the policy unless a Realtor directed hate speech toward a protected class while doing so.

NAR’s Code of Ethics and Arbitration Manual states that disciplinary action may be taken against a member “[o]n a member being convicted, adjudged, or otherwise recorded as guilty by a final judgment of any court of competent jurisdiction of a felony or a crime involving moral turpitude.”

The provision relates to membership qualification and when Ryan was sentenced to jail last month, NAR confirmed that she remains a Realtor and said Realtor membership qualification criteria are enforced at the local association level. Ryan’s local association, the Collin County Association of Realtors in Plano, Texas, did not respond to requests for comment.

As the year progressed, NAR rolled out case interpretations for the hate speech policy to help professional standards volunteers evaluate complaints. In May, the trade group’s Professional Standards Committee approved one that said a Realtor’s publicly stated interpretation of religious scripture can violate the Realtor Code of Ethics.

That particular case interpretation would later become relevant to a case that may be the first big test of the policy: In November, Montana-based pastor and Realtor Brandon Huber filed a lawsuit against the Missoula Organization of Realtors to stop the association from sanctioning him for allegedly saying that members of the LGBTQ community were an “abomination.” The trade group’s ethics case against Huber is stalled as the lawsuit is ongoing.

Also in November, NAR approved a case interpretation of the hate speech policy that makes display of the Confederate flag a violation of the Realtor Code of Ethics. The case interpretation, which prompted passionate debate before it was adopted, says that a Confederate flag displayed in listing photos could be “reasonably construed as indicating a racial preference or illegal discrimination based on a protected class” on the part of a listing broker.

The Confederate flag case interpretation was far from universally accepted among the trade group’s membership, the vast majority of whom have declined opportunities for fair housing training offered by NAR.

At NAR’s annual conference last month, then-NAR President Charlie Oppler ended his one-year tenure by urging Realtors to continue to work toward closing the racial wealth gap. So far, he said, only 30,000 members — out of 1.5 million — have completed NAR’s one-year-old fair housing Fairhaven training and 28,000 members have watched NAR’s implicit bias video.

NAR ends up locked in battle with the DOJ

Getty Images/bpperry

At the end of 2020, NAR and the DOJ seemed to be in lockstep. The DOJ had sued the trade group in November over NAR rules the federal regulator deemed constraints on competition, but had filed a proposed settlement at the same time. Shortly thereafter, as required by the settlement, NAR sent the DOJ proposed rule changes, but after the new administration took over the agency, the two became embroiled in a different fight: the DOJ wanted to modify their deal in order to protect the agency’s ability to investigate other NAR rules, but NAR refused.

On July 1, the DOJ abruptly withdrew from the settlement and five days later, the DOJ sent NAR a new civil investigative demand, launching an antitrust investigation of NAR’s MLS rules, including policies on buyer broker commissions and pocket listings. NAR has sued the agency to stop the probe, arguing in its latest volley against the DOJ that the agency had agreed to close investigations into those rules as part of the settlement, but never did.

Meanwhile, NAR is fighting several antitrust lawsuits against those commission and pocket listing rules.

NAR is currently defending itself from multiple antitrust lawsuits from homesellers and a homebuyer that seek to have homebuyers pay their broker directly, rather than have listing brokers pay buyer brokers from what the seller pays the listing broker — a move that could upend the U.S. real estate industry by effectively forcing changes in how buyer’s agents are traditionally compensated.

While one homebuyer, Alfio Conti, voluntarily dismissed his own lawsuit two months after filing it earlier this year, the other homebuyer suit, known as Leeder after its lead plaintiff, continues, as do the seller suits known as Moehrl and Sitzer, which are still in discovery and in the midst of seeking class certification.

NAR is also fighting antitrust suits from private listing groups Top Agent Network and ThePLS.com over its controversial Clear Cooperation Policy, which requires listing brokers to submit a listing to their MLS within one business day of marketing a property to the public. Both suits are in appeal and the DOJ has gotten permission to speak at oral arguments in The PLS’s appeal in January.

Flame-throwing discount brokerage REX Real Estate filed an antitrust suit against NAR in March over a rule that allows — but does not require — MLSs to mandate that listings derived from non-MLS sources be displayed separately on Internet Data Exchange (IDX) websites. IDX websites display a pooled set of listings from an MLS. REX eschews MLSs.

On top of all this, in July, the Biden Administration directed the FTC, which shares responsibility over antitrust with the DOJ, to exercise its rule-making authority “in areas such as … unfair occupational licensing restrictions; unfair tying practices or exclusionary practices in the brokerage or listing of real estate; and any other unfair industry-specific practices that substantially inhibit competition.” What comes of this directive is yet to be seen.

As NAR, the largest trade group in the country, faced increased increasing regulatory and legal pressure with no end in sight, it launched a website last month to defend itself in the “court of public opinion.”

NAR changes policies on commissions, buyer agents, listing attribution

National Association of Realtors Board of Directors Meeting, November 2021

Even after the DOJ pulled out of its settlement with NAR, last month the trade group went ahead and changed most of the rules the federal agency had objected to in its original lawsuit.

As of January 1, Realtor agents and brokers will not be allowed to advertise their services as free unless they will not actually receive any compensation from anyone for them. They will also not be allowed to filter out listings from website displays based on buyer broker commissions or the name of the brokerage or agent.

Most controversially, MLSs will be required to display buyer broker commissions on their listing sites and to include buyer broker commissions in the data feeds they provide to agents and brokers.

NAR policy previously allowed MLSs to prohibit disclosing to prospective buyers the total commissions offered to buyer brokers on agent and broker IDX sites and Virtual Office Websites (VOWs).

The three policies are designed to better inform consumers, particularly buyers, about their role in compensating buyer brokers and agents as clamor grows for the uncoupling of commissions.

At the end of November, the Consumer Federation of America published a study of more than 10,000 home sales finding that buyer agent commission rates are largely the same across nearly two dozen U.S. cities, indicating a lack of competition in the industry. The nonprofit watchdog called for the uncoupling of commissions to spur price competition and potentially save consumers thousands of dollars per home sale, or tens of billions of dollars annually combined.

Per the new NAR policy, brokers and agents using MLS feeds will not be required to display buyer broker commissions, so the policy’s impact may be muted depending on how many brokerages decide against display. In addition, in the wake of the settlement, at least 65 MLSs had already changed their rules to allow public display of buyer agent commissions.

In 2022, it’s likely the trade group will take up another rule the DOJ objected to: a policy allowing MLSs to prohibit non-Realtor licensees from accessing lockboxes. Other possible targets for NAR’s MLS policy committee include “Coming Soon” listings and days on market, both of which are controversial and saw increased attention this year and last year.

NAR also changed a policy on listing attribution that will require agent and broker listing websites to display the email address or phone number of the listing brokerage next to listings. Previously, only the name of the listing brokerage was required. The NAR board passed the policy after the trade group’s MLS committee stripped the proposal of its most controversial aspects.

The battle this particular policy proposal prompted is only the latest in the industry’s complicated relationship with online listing display, which pits the desire of some listing agents to get every lead generated by their listing against the desire of buyer agents to represent those who want to buy those listings. That fight shows no signs of ending.

Lastly, NAR changed up its leadership and governance last month, ushering in a majority-female leadership team for 2022 for the first time in its history and overhauling its board of directors transferring some power to the board’s smaller Executive Committee.

This means that fewer Realtors will be making most policy decisions, but those Realtors will make those decisions faster and in view of other NAR members. How the changes will impact the dynamics between the new EC and the new board remain to be seen, but it will be awhile before the changes fully kick in: not until 2024.

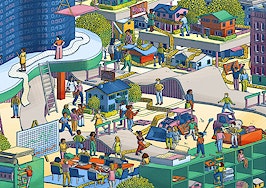

Zillow acquired ShowingTime and MLSs gained an appetite for investment

Ash Ponders/AJ Canaria of PlanOmatic/Zillow

In the real estate tech world this year, few acquisitions made a bigger splash than Zillow’s acquisition of showing management firm ShowingTime, announced in February. Up until that point ShowingTime had been a popular platform among agents, but after the acquisition news many expressed concerns about how Zillow might handle their data, among other things. (Zillow has vowed to keep ShowingTime’s privacy policies in place.)

Since then, numerous showing management companies told Inman they were experiencing a tsunami of interest from brokerages, MLSs and agents. MLSs began hearing protests from their subscribers about using a service owned by a rival brokerage and MLSs themselves began teaming up with ShowingTime competitors through acquisitions and investments.

Last month, MLS Aligned — a company owned by a group of multiple listing services — said it was preparing a new offering called Aligned Showings. Shortly thereafter, the Houston Association of Realtors announced its own showing service, dubbed ShowingSmart, and fellow mega MLS Realtracs announced its own Realtracs Showings. Three major MLSs have also joined forces to come up with showing data standards to give brokers more choices about which showing services to use.

And it’s not just showings that MLSs are delving into. In October, four MLSs formed MLS Technology Holdings LLC in order to acquire real estate software firm Remine and for potential future investments. In November, Art Carter, CEO of California Regional MLS, the nation’s largest MLS, teased its plans to make at least two tech investments and spoke of having been “burned by situations where vendors that we’re relying upon may not be ultimately owned by organizations that our brokerage community feels comfortable with,” referring to Compass’s acquisition of offers tool Glide and Zillow’s purchase of ShowingTime.

Earlier this month, CRMLS revealed it had created a venture fund and invested in its first target: real estate data platform Perchwell. Carter said the fund would serve agents’ and brokers’ need for “high-quality technology that enables them to do their jobs without worrying about how their data gets used.”

Still, this particular trend prompted Inman tech writer Craig Rowe to ask, “How can this not further complicate how due diligence on other products is handled, especially when they provide comparable services? Thus, does it best serve members, or the politics and public image of their organization?”

Given that some large MLSs have millions in reserves and tech acquisitions overall show no signs of abating, we’ll see what answers await in 2022.